child tax credit november 2021 payments

The monthly child poverty rate increased from 121 percent in December 2021 to 17 percent in January 2022 the highest rate since the end of 2020. Thank you for visiting our web page about economic impact payments EIP the Child Tax Credit CTC and other refundable tax credits.

Did Your Advance Child Tax Credit Payment End Or Change Tas

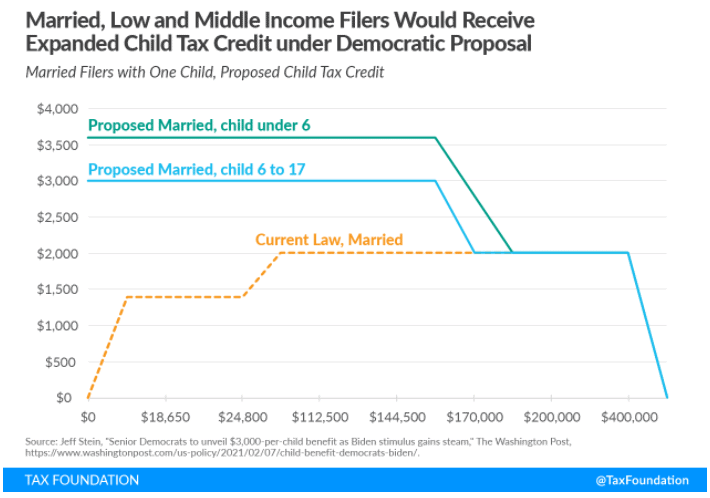

The Tax Cuts and Jobs Act temporarily increases the Child Tax Credit to up to 2000 per child.

. Additional information about the IRS portal allowing you to follow update or even opt-out of the new payments will also be provided. The federal Child Tax Credit is kicking off its first monthly cash payments on July 15 when the IRS will begin disbursing checks to eligible families with children ages 17 or younger. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line.

Way for people who do not ordinarily file a tax return with the IRS to claim advance CTC payments and missing stimulus payments or EIPs. The Child Tax Credit CTC for 2021 has some important changes stemming from the American Rescue Plan ARP. Under the Build Back Better Act you generally wont receive monthly child tax credit payments in 2022 if your 2021 modified AGI is too high.

The thresholds for monthly payment ineligibility are. FS-2021-13 November 2021 PDF. Unless the expanded child tax credit is extended parents of 2022 babies will not be receiving monthly checks or the full 2021 amount of 3600.

In addition to missing out on monthly Child Tax Credit payments in 2021 a failure to file in 2020 could mean. The November 15 2021 deadline to use the tool has passed. But this can be an issue with the CTC since the IRS is relying on 2019 or 2020 tax returns to send out the advance payments of a 2021 tax credit.

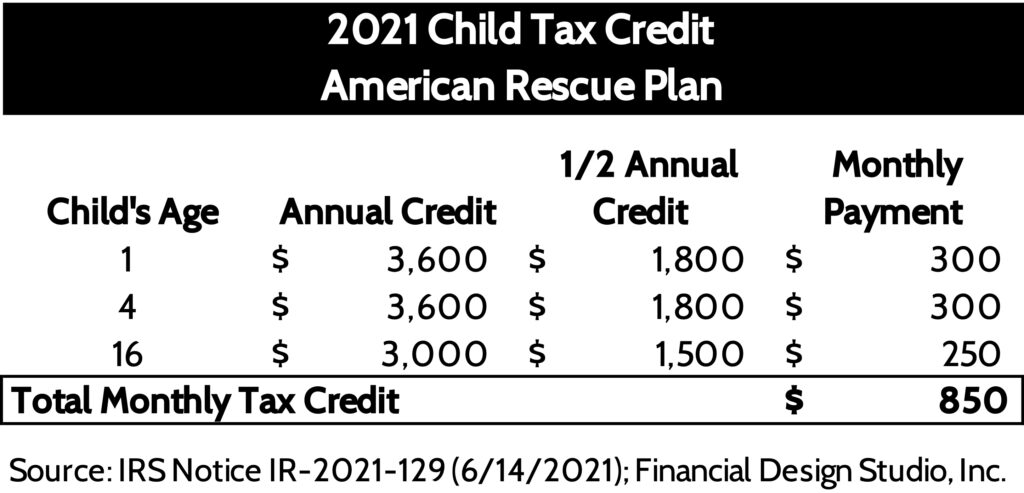

Page Last Reviewed or Updated. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. Their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child.

The 2021 child tax credit was temporarily expanded from 2000 per child 16 years old and younger to 3600 for children age 5 and younger and to 3000 for children age 17 and younger. The deadline to sign up for monthly Child Tax Credit payments is November 15. Find answers about advance payments of the 2021 Child Tax Credit.

The American Rescue Plan expanded the amount of Child Tax Credit CTC allowed for 2021. The 49 percentage point 41 percent increase in poverty represents 37 million more children in poverty due to the expiration of the monthly Child Tax Credit payments. These updated FAQs were released to the public in Fact Sheet 2022-29PDF May 20 2022.

The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to. Learn what the changes are who qualifies payment amounts and when those payments will be issued. A portion of the child tax credit was sent as an advanced monthly payment via direct deposit if available or check on or around July 15 August 13 September 15 October 15 November 15 and December 15 2021.

Babies born in 2022 and beyond. That means one parent could end up with the tax. That means a baby.

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

The Child Tax Credit Toolkit The White House

2021 Child Tax Credit Payments Does Your Family Qualify

2021 Advanced Child Tax Credit What It Means For Your Family

1040 2020 Internal Revenue Service Internal Revenue Service Worksheets Instruction

2021 Advanced Child Tax Credit What It Means For Your Family

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

2021 Child Tax Credit Advanced Payment Option Tas

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

Child Tax Credit Delayed How To Track Your November Payment Marca

Child Tax Credit Delayed How To Track Your November Payment Marca

Child Tax Credit Update Next Payment Coming On November 15 Marca

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

2021 Child Tax Credit What It Is How Much Who Qualifies Ally